FXAIX vs. FSKAX: Which Is a Better Buy? (2023)

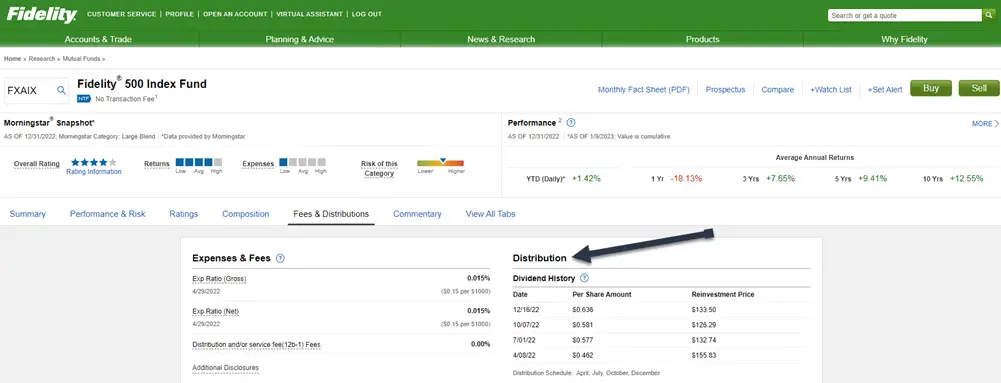

Not all index funds are created equal. Some of them have different goals, structure, or fees. For example, the Fidelity Total Market Index Fund (FSKAX) has some advantages over its peer: the Fidelity 500 Index Fund (FXAIX). In this article, we’ll take a look at how they compare and which one might be better for … Read more