With the global economy continually advancing, investors have an increasing array of international index funds to choose from.

Two of the most popular international index funds from Fidelity are FTIHX and FSPSX.

Both offer exposure to foreign stocks, but there are some key differences between them. In this article, we’ll look at the two and discuss which is better for your portfolio.

Key Takeaways

FTIHX: Fidelity Total International Index Fund

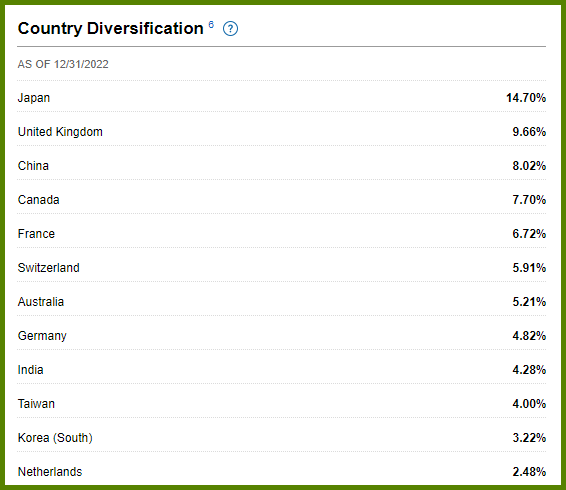

FTIHX is a mutual fund that tracks the MSCI ACWI (All Country World Index) ex USA Investable Market Index.

This index includes over 5,000 large- and mid-cap stocks from developed countries outside the US, such as Japan, France, Taiwan, and Switzerland.

The fund has a 0.07% expense ratio and invests in both growth and value stocks. It also has a relatively low turnover rate of 3%.

The top 10 holdings from FTIHX are:

| COMPANY | SYMBOL | TOTAL NET ASSETS |

|---|---|---|

| Taiwan Semiconductor Manufacturing Co. Ltd. | TSMWF | 1.35% |

| Nestle S.A. | NSRGF | 1.20% |

| Tencent Holdings Ltd. | TCTZF | 1.00% |

| Novo Nordisk A/S Series B | NONOF | 0.85% |

| ASML Holding N.V. | ASMLF | 0.84% |

| AstraZeneca PLC | AZNCF | 0.79% |

| Roche Holding AG Part. Cert. | RHHVF | 0.79% |

| Samsung Electronics Co. Ltd. | SSNLF | 0.79% |

| Shell PLC A | RYDAF | 0.77% |

| LVMH Moet Hennessy Louis Vuitton SE | LVMHF | 0.76% |

FSPSX: Fidelity International Index Fund

FSPSX is another Fidelity mutual fund that invests in foreign equities, which tracks the Morgan Stanley Capital International Europe, Australasia, Far East Index.

Compared to FTIHX, this fund’s portfolio is smaller, containing only around 800 companies from the international stock markets.

FSPSX has an expense ratio of only 0.035%, which is half what its counterpart charges.

FTIHX vs. FSPSX: Comparison Table

| Funds | Fidelity Total International Index Fund | Fidelity International Index Fund |

|---|---|---|

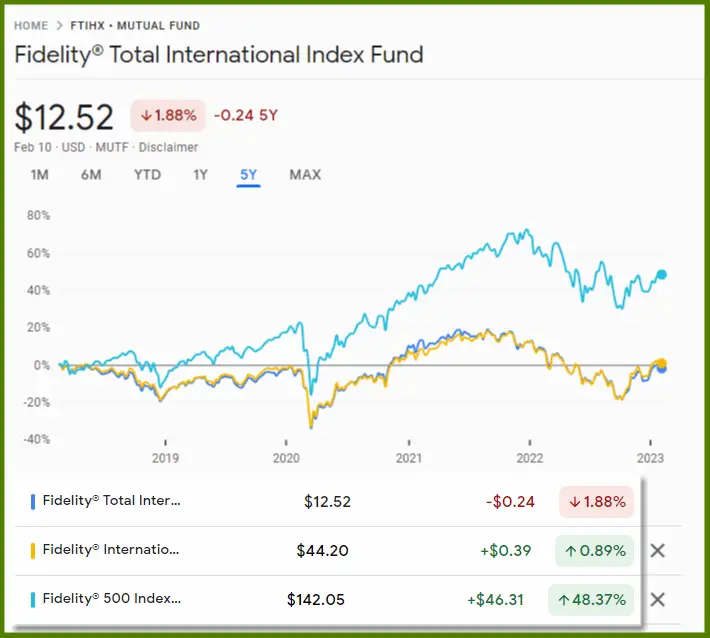

| Price | 12.52 (NAV) | 44.20 (NAV) |

| 3-year total return | +4.20% | +4.80% |

| Min. initial investment | 0.00 USD | 0.00 USD |

| Net expense ratio | 0.06% | 0.04% |

| Total net assets | 9.84bn USD | 39.96bn USD |

| Morningstar category | Foreign Large Blend | Foreign Large Blend |

Which International Fund Is Better in 2023?

Before we determine which mutual fund is the winner, let’s go over some of the differences between FTIHX and FSPSX.

One significant difference is that FTIHX has a more extensive portfolio of 5000+ equities, whereas FSPSX only holds 800+ stocks.

When it comes to fees, the expense ratio of FTIHX is 0.07% while FSPSX’s expense ratio is only 0.035%. These numbers are relatively small and can be insignificant; it’s still cheaper to invest in FSPSX than FTIHX.

So, which is better?

Over the past 10 years, both funds have averaged under 6%. To provide context, the Fidelity S&P 500 Index Fund (FXAIX) has averaged 12.67% over the same period.

If you desire direct international exposure, limit it to no more than 10% of your overall portfolio.

As for the winner, FSPSX would be the preferred choice because of its lower fees and significantly larger net assets compared to FTIHX.

And remember, the top companies in the S&P 500 have an international footprint. Therefore, while I’d still invest in at least one international index fund for diversification, I’m keeping it to a minimum.