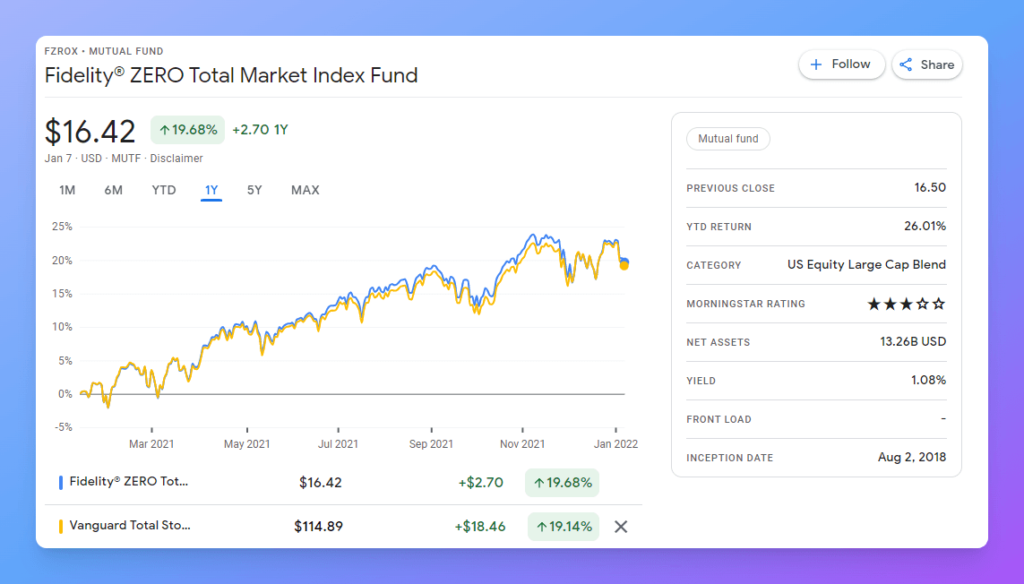

The Fidelity equivalent of VTSAX is FZROX (Fidelity ZERO Total Market Index Fund).

FZROX provides exposure to the entire U.S. stock market, including small-, mid-, and large-cap stocks. It has no expense ratio and has performed similarly to VTSAX over the long term.

The fund’s holdings are well diversified across different sectors.

A Quick Glance at FZROX

| Funds | Fidelity® ZERO Total Market Index Fund |

|---|---|

| 3-year total return | +25.81% |

| 3-year standard deviation | 18.21% |

| Morningstar rating | ⭐⭐⭐ |

| Min. initial investment | 0.00 |

| Net expense ratio | 0.00% |

| Total net assets | 13.26bn USD |

| Morningstar category | Large Blend |

| IMA sector | 25.81 |

FAQs

FZROX does not charge a yearly fee.

Yes, it does. Fidelity ZERO Total Market Index Fund (FZROX) pays dividends once a year to shareholders.

FZROX is a Fidelity’s mutual fund, it is not an ETF.

FZROX is a total market fund that really only holds like 75% of the market. It’s a 0 expense ratio because it relies on lending its shares to short sellers for income.

It has 2662 holdings as of 9/30/2021.

Is FZROX a Good Buy?

Imran M wrote –– Mar 15, 2020

I prefer FSKAX over it. FZROX distributes dividends annually and has the least number of holdings within the fund.

Joseph J wrote — Jan 18, 2021

Stephan Graham did a video on low cost index funds and FZROX seemed like the best one. Literally $0 cost expense ratio. A few of my best friends work at Fidelity and they were on that project. They definitely recommended it.