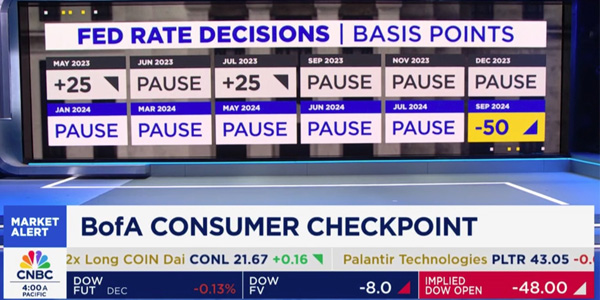

Rate Cut Era ✂️ What happens to SPAXX when Fed cuts rates?

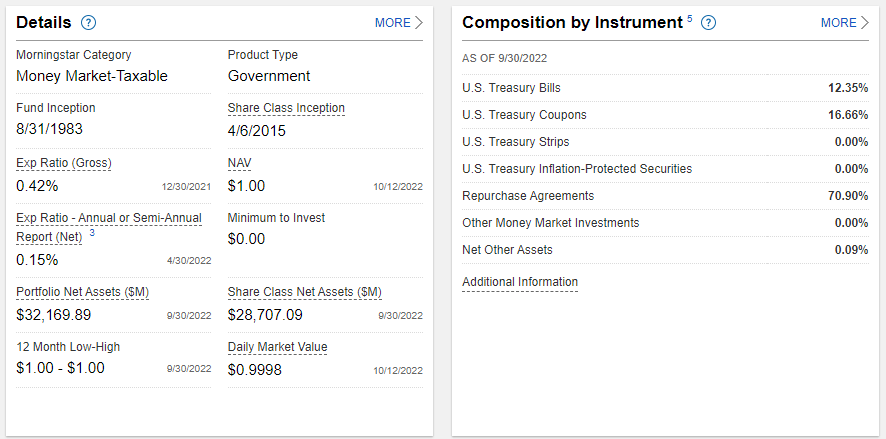

Holding cash on the sidelines in a Fidelity SPAXX money market account? You may be wondering how fed funds rate cuts impact your savings rate. Fidelity’s SPAXX government money market fund is your Fidelity.com account’s cash sweep account, where your money is held before it’s deployed into buying stocks. Thru Fidelity’s bank partner UMB Bank … Read more

![[Explained] 👩🏫 What Is SPAXX in your account on Fidelity.com? 5 spaxx interest calculator](https://usefidelity.com/wp-content/uploads/2023/09/spaxx-interest-calculator.png)