FXAIX and IVV are outstanding index funds that focus on large-cap stocks.

As such, they’re often compared to one another by investors looking for exposure to the U.S. stock market without taking on excessive risk or paying too much in fees.

But how do these two funds compare? And which is better for your portfolio?

Let’s find out.

FXAIX: Fidelity® 500 Index Fund

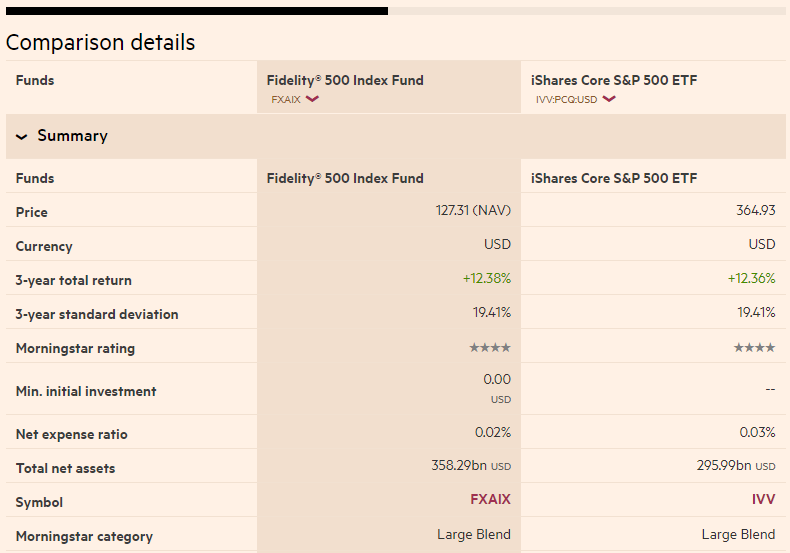

The Fidelity 500 Index Fund (FXAIX) has been around since 2011. It currently tracks the S&P 500 index and has over $358 billion in assets under management.

FXAIX is one of the best mutual funds with the lowest expense ratios (0.02%).

IVV: iShares Core S&P 500 ETF

IVV is a fantastic choice for investors who want to invest in the S&P 500.

It is an inexpensive ETF that closely mirrors the index and affordably provides exposure to all 500 stocks.

The expense ratio of IVV is 0.03%.

FXAIX vs IVV: Key differences

IVV has a higher expense ratio than FXAIX (0.03% vs. 0.02%, respectively). Though, the difference is minor and won’t affect returns.

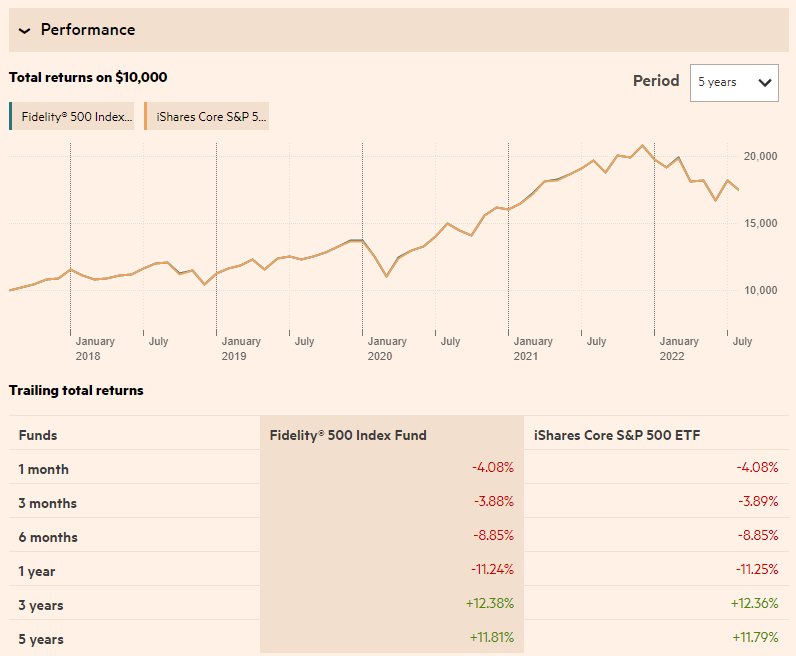

Although both funds track the same benchmark, IVV is an ETF, while FXAIX is a mutual fund. This means investors can trade shares of IVV during market hours. As for FXAIX, it can only be bought and sold after the market close.

FXAIX vs IVV: Which Is Better?

FXAIX and IVV have given investors excellent returns for their investments in the past 5 years, with an average annualized return of 11.80%.

Both funds share comparable holdings because they follow the S&P 500 index.

FXAIX has a slight advantage over IVV because it’s cheaper to own!

It’s not obvious why the actively managed mutual fund, FXAIX, has a lower (net) expense ratio than the passively managed ETF. If expenses for the mutual fund also include sales/front loads and other transaction fees that are not included in the net expense ratio, why would the IVV passively-managed fund not be a less expensive fund to own?