Someone asks:

What are your thoughts on VTSAX vs VWUSX? The Vanguard U.S. Growth Fund has a higher expense ratio, but it consistently outperforms the Vanguard Total Stock Market Index.

For the next 30 years, I don’t intend to touch my portfolio. I’m trying to identify mutual funds that outperform index funds.

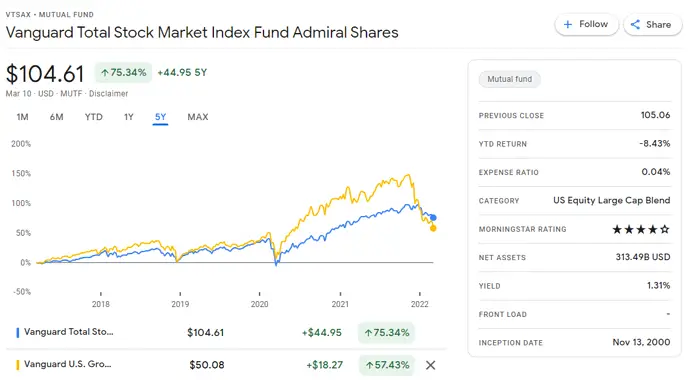

VTSAX vs VWUSX: Fund Comparison

| Funds | Vanguard Total Stock Market Index Fund Admiral Shares | Vanguard U.S. Growth Fund Investor Shares |

|---|---|---|

| Price | 104.61 (NAV) | 50.08 (NAV) |

| 3-year total return | +17.46% | +19.99% |

| 3-year standard deviation | 18.44% | 22.75% |

| Morningstar rating | ||

| Min. initial investment | 3,000.00 USD | 3,000.00 USD |

| Net expense ratio | 0.04% | 0.38% |

| Total net assets | 313.49bn USD | 9.54bn USD |

| Morningstar category | Large Blend | Large Growth |

VTSAX vs VWUSX: Historical Performance

| Funds | Vanguard Total Stock Market Index Fund Admiral Shares | Vanguard U.S. Growth Fund Investor Shares |

|---|---|---|

| 1 month | -2.55% | -4.69% |

| 3 months | -4.93% | -19.09% |

| 6 months | -4.53% | -19.83% |

| 1 year | +11.93% | -8.23% |

| 3 years | +17.46% | +19.99% |

| 5 years | +14.64% | +19.47% |

Which is Better, VTSAX or VWUSX?

Community Answers:

Larry K:

VWUSX has been consistent since 1959. You’d be hard-pressed to find another fund that has produced 11.3% gains over 60 years. That’s counting all the bad years.

Andrew L:

The “logic” is that you MAY have better total returns if you take on some extra RISK. VTSAX does involve some risks. VWUSX consists of a bit more risk. That’s a decision every investor has to make for himself.

Bob S:

VTSAX tracks the Total Stock Market (very close to S&P 500 as comparisons of performance will show but a different, broader index).

VWUSX, on the other hand, is not an index fund but invests principally in larger US stocks. This fund’s history shows it has a Beta of 110, recognizing that it has more volatility than an index fund that tracks the market.

Now VWUSX is one of the few funds that has beaten VTSAX over the long term.

So, which is best? The conservative investor would take VTSAX. The market has gained about 10% per year (incl dividends). So, I’m comfortable with the index.

Since the vast majority of the time, the market has produced gains, which may persuade some to take VWUSX since the market goes up over the long term.

It’s hard to argue with results: VWUSX beats VTSAX over the long term. If I were a long-term investor, I would lean towards VWUSX.

There is no bad choice here, though!!

Joe M:

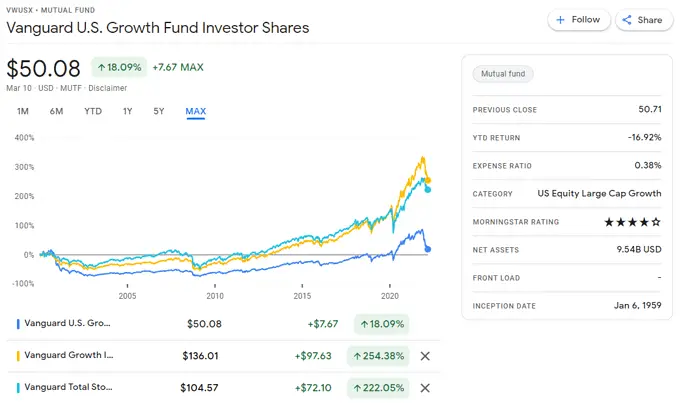

VWUSX hasn’t always been so rosy. If you backtest it back to the 90s, a time that was very good for growth funds, it actually underperformed its peers, and you still wouldn’t have caught up. I would stick with VTSAX.

Here’s a chat comparing VWUSX with VIGRX (growth index) and VTSMX (total market).

What is the Fidelity Equivalent of VTSAX?

FSKAX is the Fidelity equivalent of VTSAX. It is the ticker symbol for Fidelity Total Market Index Fund, which tracks the Dow Jones U.S. Total Stock Market Index.

FSKAX has an expense ratio of 0.015% (cheaper than VTSAX).

What is the Fidelity Equivalent of VWUSX?

FSPGX is the Fidelity equivalent of VWUSX. It is the ticker symbol for Fidelity Large Cap Growth Index Fund, which invests in stocks included in the Russell 1000 Growth Index.

The expense ratio of FSPGX is 0.035% (cheaper than VWUSX).

Similar Comparisons

1 post – 1 participant